are donations to election campaigns tax deductible

If you contribute to a candidate or political campaign you may be wondering are donations to political campaigns are tax-deductible. Please donate to Bradys efforts to prevent gun violence.

If youre looking to save more on your taxes this year find out if youre eligible for any of these 10 most.

. Are Political Donations Tax Deductible. All four states have rules and limitations around the tax break. So if you support your favorite candidate you.

States which offer a tax credit not tax deductions to political donations include. They give their time effort and support to the candidates and their parties. The IRS tells clear that all money or effort time contributions to political campaigns are not tax deductible.

Foreign organizations other than certain Canadian Israeli or Mexican charities. Donations utilized before or after the campaign period are subject to donors tax and not deductible as political contributions on the part of the donor. People love to support their favorite candidate.

Arkansas Ohio and Oregon offer a tax credit while Montana offers a tax deduction. Individuals can contribute up to. Furthemore the same goes for campaign donations.

The answer is no donations to political candidates are not tax deductible on your personal or business tax return. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible. Americans are encouraged to donate to political campaigns political parties and other groups that influence the political landscape.

Only those donations or contributions that have been utilizedspent during the campaign period as set by the Comelec are exempt from donors tax. So for example if you donate to a political party candidate or even a political action committee the contributions will not be tax-deductible. Supreme Courts right-wing majority struck down a campaign finance regulation limiting federal candidates ability to use campaign funds to repay personal loans.

Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns. If you are one of those citizens and you were hoping for a tax break unfortunately you wont find one here. This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible.

All four states have rules and limitations around the tax break. Donations utilized before or after the campaign period are subject to donors tax and not deductible as political contribution on the part of the donor. On the part of the candidate to whom the contributions were given Revenue Regulations 7-2011 provides that as a general rule the campaign contributions are not included in their taxable income.

Businesses cannot deduct contributions they make to political candidates and parties or expenses related to political campaigns. When they give money to repay the victors. The program is voluntary and is only available to mayoral or council candidates.

The answer is simple No. Though political contributions are not tax-deductible many people still willingly spend their money on the election campaign. According to the Internal Service Review IRS The IRS Publication 529 states.

Although political contributions are not tax-deductible there is always a limit to the amount that can be contributed to a political campaign. You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund. Can a deduction to a political campaign be deducted on the donors federal income tax return.

As a rule of thumb donations are tax-deductible if the campaigns beneficiary has 501 c 3 status with the IRS. Generally a taxpayer is allowed a deduction for any charitable contribution that is made during the tax year. The same goes for campaign contributions.

100 of your donation goes to fight gun violence. 10 hours agoIn a decision Monday that liberal Justice Elena Kagan warned will further corrupt the nations money-dominated political system the US. Below we provide a list that IRS says is not tax deductible.

The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations. Arkansas Ohio and Oregon offer a tax credit while Montana offers a tax deduction. While political contributions arent tax-deductible many citizens still donate money time and effort to political campaigns and to support political candidates.

Givebutter defines the beneficiary as the. Advertisements in convention bulletins and admissions to dinners or programs that benefit a political party or political candidate are not deductible. Hence the answer is no contributions to political candidates are not tax-deductible on your personal or business tax return.

If youd like to make a non-tax-deductible donation to the Brady Campaign Bradys 501c4 organization please visit this page. In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates. When it comes time to file taxes though many people may not fully understand what qualifies as a tax deduction.

Brief On Donations To Political Campaigns Not Being Tax-Deductible Any payment contributions or donations to political groups or campaigns are not tax-deductible. Both in-kind donations of goods and monetary donations will be tax-deductible. According to the IRS.

In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates. The answer is no. And if you check the box when filling out your tax return that asks if you want to give 3 to the Presidential Election Campaign Fund that isnt deductible either.

If you decided to donate money or time or effort to political campaign you might wonder whether political contributions that you make are tax deductible. Candidates for the position of trustee cannot participate. Simply put political contributions are not tax-deductible.

Political contributions deductible status is a myth. Political Contributions Are Tax Deductible Like. The contribution refund program was created because contributions to municipal election campaigns are not tax deductible.

Individuals may donate up to 2900 to a candidate committee per election 5000 per year to a.

Donate To Labor S Federal Election Campaign Fund

Are Political Contributions Tax Deductible Taxact Blog

Pdf Money In Politics Sound Political Competition And Trust In Government

The Complete Political Fundraising 2022 Guide Numero Blog

Are Political Contributions Tax Deductible Anedot

Sunburn The Morning Read Of What S Hot In Florida Politics 3 24 22

Recall Backers Raise More But Newsom S Side Has More Cash Calmatters

Contribute Village Republican Women

Taxability Of Campaign Contributions

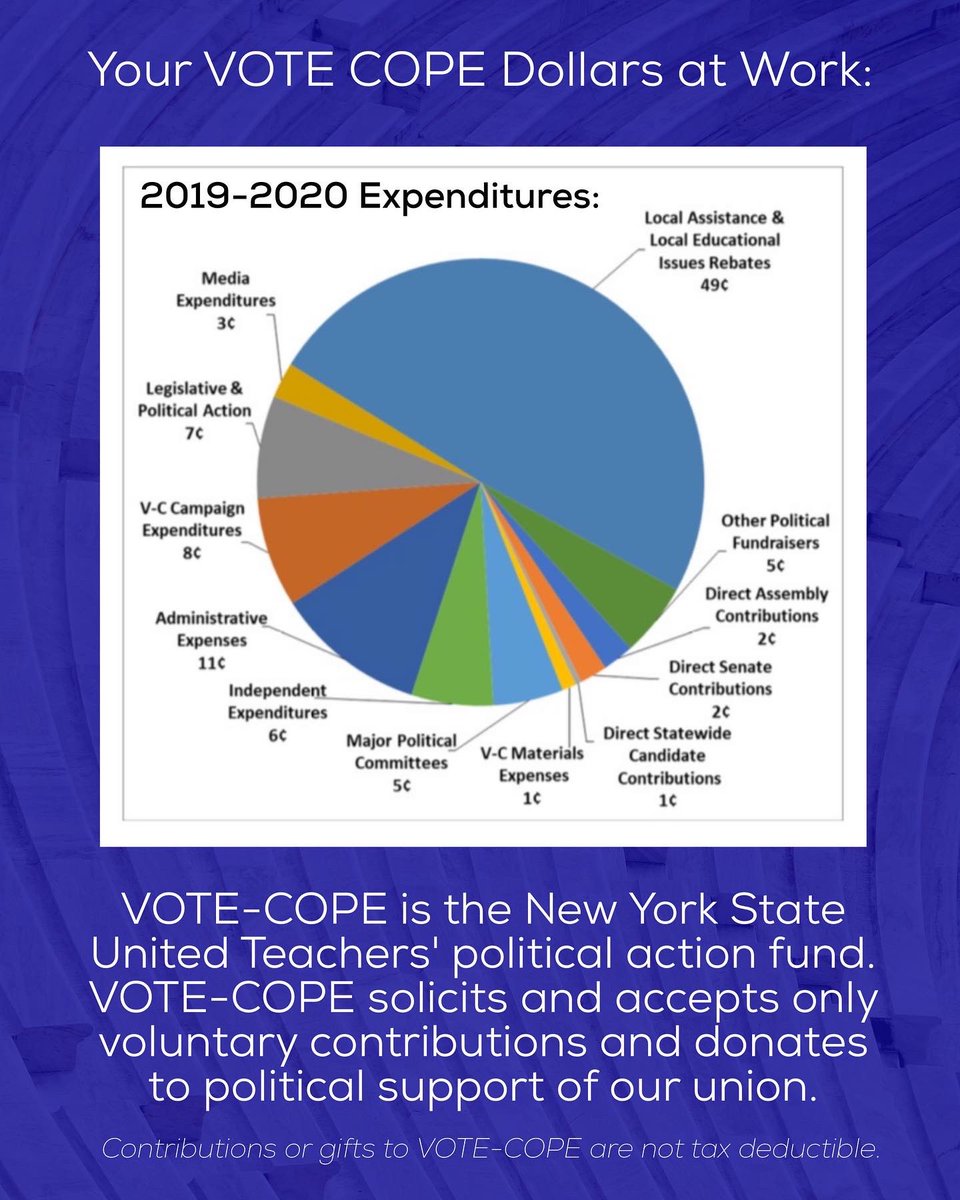

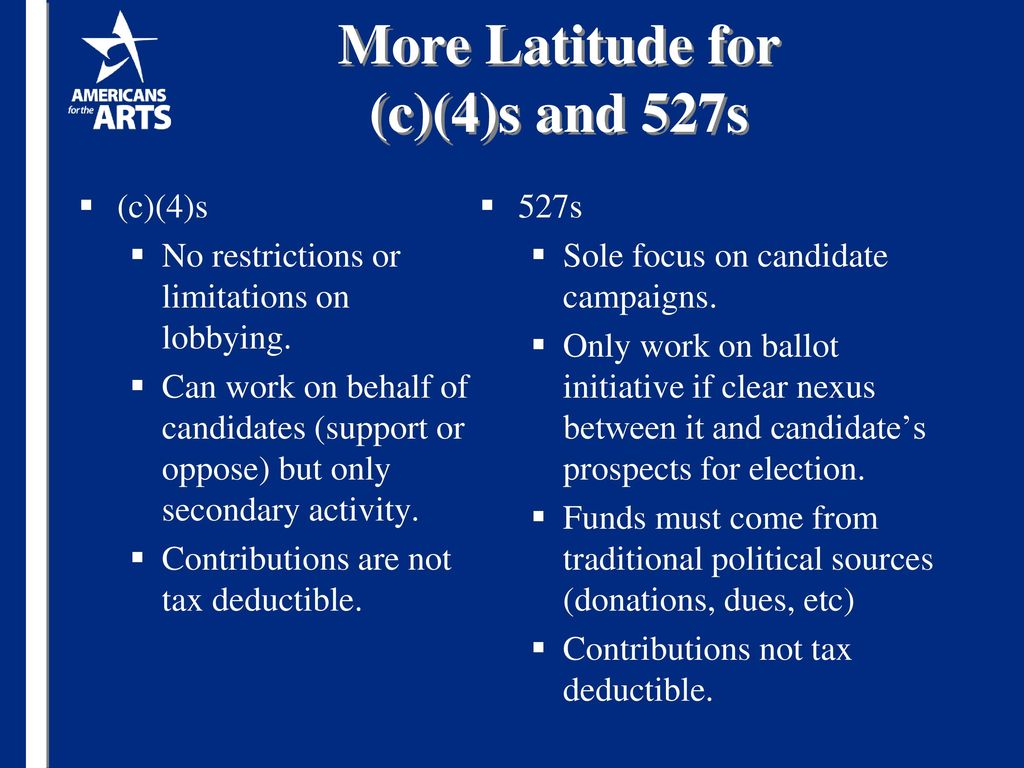

Education Advocacy Lobbying 501 C 3 Do S And Don T Ppt Download

Pdf Money In Politics Sound Political Competition And Trust In Government

Pdf Money In Politics Sound Political Competition And Trust In Government

Utilizing Unutilized Campaign Contributions Atty Rodel C Unciano

Political Financing Handbook For Candidates And Official Agents Ec 20155 June 2019 Archived Content Elections Canada

Republican Leaders Donors Clash In State Senate Special Election This Saturday Kera News

What The Hell Is Actblue And Why Is It Showing Up On So Many Democratic Candidates Campaign Finance Reports Minnpost