philadelphia transfer tax form

How much are transfer taxes in PA. USE TO UPDATE ACCOUNT INFORMATION OR TO CANCEL A TAX LIABILITY Businesses complete Sections 1 and 2 to add a tax request payment coupons or to close a business account.

P J Whelihan S In Horsham Pa Bars In Philly Horsham Chester University

The new owner must apply for a new Tax Account Number and a new Business privilege License.

. BOX 1410 PHILADELPHIA PA 19105-1410. Transfer form 01t instructions - utah transfer on death deed form. Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a total of 4278.

Philadelphia Code 19-1405 6 exempts transfers between. If you are selling or transferring your business you must file a Change Form in order to cancel your tax liability with the City. The current rates for the Realty Transfer Tax are.

Consider the transfer tax sometimes known as a tax stamp to be a type of sales tax on real estate. Get the free philadelphia realty transfer tax form 2011-2022. Get philadelphia transfer tax form signed right from your smartphone using these six tips.

If you take an interest in Fill and create a Philadelphia Real Estate Transfer Tax Certification - City Of Philadelphia heare are the steps you need to follow. To begin the form utilize the Fill camp. Instructions for completing realty transfer tax statement of value this statement must be signed by a responsible person connected with the transaction.

Complete the correct certificate and submit it when you record the deed or mail in your Realty Transfer Tax. CITY OF PHILADELPHIA DEPARTMENT OF REVENUE PO. The state of Pennsylvania charges one percent of the sales price while the municipality and school district each charge one percent of the sales price for a total of two percent ie.

INSTRUCTIONS FOR COMPLETING PHILADELPHIA REAL ESTATE TRANSFER TAX CERTIFICATION Section A Correspondent. If no sales price exists the tax is calculated using a formula based on the property value determined. The way to complete the Philadelphia form transfer taxsignNowcom 2011-2019 online.

If no sales price exists the tax is calculated using a formula based on the property value determined by the Office of Property Assessment OPA. Ad Download Or Email Form 82-127 More Fillable Forms Register and Subscribe Now. Section B Transfer Data.

PA Realty Transfer Tax and New Home Construction. Provide the name of the decedent and estate file number in the space provided. Philadelphia transfer tax law excludes 28 transactions while pennsylvania transfer tax law excludes 34 transactions.

One of the most popular transfer tax exemptions is the intra-family exemption. REV-1651 -- Application for Refund PA Realty Transfer Tax. Enter your official identification and contact details.

Hit the Get Form Button on this page. 2 x 100000 2000. Recently taxpayers have taken advantage to substantial discrepancies between assessed and market values to lower realty.

Both grantor and grantee are held jointly and severally liable for. Sell or transfer a business. 2 percent X 100000 2000 in Pennsylvania.

Ad Download Or Email Form 82-127 More Fillable Forms Register and Subscribe Now. REV-1728 -- Realty Transfer Tax Declaration of Acquisition. Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted-for improvements to property transferred by deed instrument long-term lease or other writing.

MAIL THE COMPLETED CHANGE FORM TO. CocoDoc is the best platform for you to go offering you a marvellous and easy to edit version of Philadelphia Real Estate Transfer Tax Bcertificationb as you require. Get Form Show details.

Philadelphia beginning July 1 2017 will begin to tax transfers of interests in real estate entities based on the selling price of the entity rather than the computed value assessed value102 of the realty. Failure to complete this form properly or attach requested documentation may result in the recorders refusal to record the deed. Bureau of individual taxes po box 280603.

Life Estate Remainder Chart -- Life Estate Remainder Chart. A statewide list of the factors is available at the Recorder of Deeds office in each county. Sign Online button or tick the preview image of the blank.

1259 approved june 11 1987 these regulations have been Transfers to an excluded party by gift or. The advanced tools of the editor will direct you through the editable PDF template. Real Estate Transfer Tax certificates.

Effective october 1 2018 the transfer tax for the city of philadelphia is 3278 with an additional state of pennsylvania tax of 1 for a total of 4278. 3278 City 1 Commonwealth 4278 Total The tax rate is based on the sale price or assessed value of the property plus any assumed debt. A divorced couple pursuant to the divorce decree Parent and child or the childs spouse Brother or sister or their spouse Grandparent and grandchild or the.

The Guide of finalizing Philadelphia Real Estate Transfer Tax Certification - City Of Philadelphia Online. When you complete a sale or transfer of real estate that is located in Philadelphia you must file and pay the Realty Transfer Tax. The city of philadelphia imposes a realty transfer tax on the sale or transfer of real property located in philadelphia.

Are you thinking about getting Philadelphia Real Estate Transfer Tax Bcertificationb to fill. THIS STATEMENT MUST BE SIGNED BY A RESPONSIBLE PERSON CONNECTED WITH THE TRANSACTION. Philadelphia PA 19102 215 686-6442 Real Estate revenuephilagov 215 686-6600 Taxes.

REV-715 -- Realty Transfer Tax Monthly Report. REV-183 -- Realty Transfer Tax Statement of Value. Husband and wife.

Enter the date on which the deed or other document was accepted by the PartyiesEnter. Enter the name address and telephone number of party completing this form. Deed transfers and entity transfers have their own unique forms.

Philadelphia transfer tax form real estate.

P J Whelihan S In Horsham Pa Bars In Philly Horsham Chester University

Small Business Legal Forms Bill Of Sale Cease And Desist Etsy Legal Forms Formal Business Letter Proposal Letter

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

What Are Real Estate Transfer Taxes Forbes Advisor

Toronto Maple Leafs Tattoo Maple Leaf Tattoo Leaf Tattoos Maple Leaf

Congressional Pugilists Griswold And Lyon At Congress Hall Philadelphia Pa The Row Was Originally Prompted B Early Modern 16th 18th Centuries

Congressional Pugilists Griswold And Lyon At Congress Hall Philadelphia Pa The Row Was Originally Prompted B Early Modern 16th 18th Centuries

Daniel Pastorius House Green Tree Tavern Germantown Germantown Historic Philadelphia Tavern

P J Whelihan S In Horsham Pa Bars In Philly Horsham Chester University

How To Get An Extension To File Your Philadelphia Business Taxes By July 15 Department Of Revenue City Of Philadelphia

Manual Method To Convert Windows Live Mail To Outlook Windows Live Mail Live Mail Online Marketing Services

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Picture Western Union Money Order Money Template Printable Play Money Money Order

Congressional Pugilists Griswold And Lyon At Congress Hall Philadelphia Pa The Row Was Originally Prompted B Early Modern 16th 18th Centuries

P J Whelihan S In Horsham Pa Bars In Philly Horsham Chester University

100 Legit Track Mtcn Before Payment Contcat Us For Your Own Mtcn Today Get Western Western Union Money Transfer Western Union Money Market Account

Minnesota Department Of Revenue Minneapolis Mn Mm Financial Consulting Minneapolis Lettering Letter I

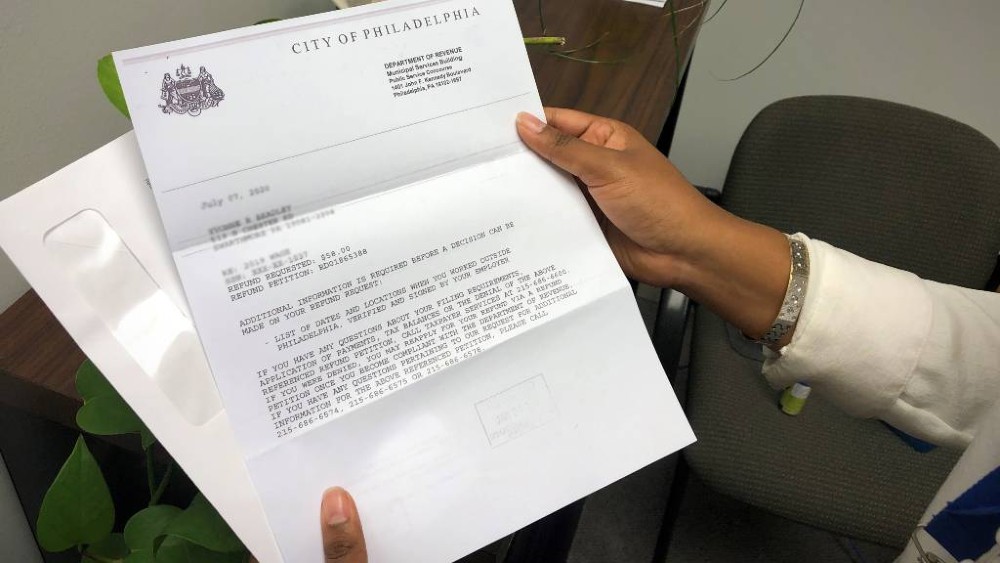

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia