south carolina estate tax exemption 2021

2021 brings an update to South Carolina rollback tax laws with potentially significant. Income from South Carolina sources includes income or gain from.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

South Carolina dependent exemption A South Carolina dependent exemption is allowed for each eligible dependent including both qualifying children and qualifying relatives.

. Starting in 2022 the exclusion amount will increase annually based on. South Carolina has no estate tax for decedents dying on or after January 1 2005. It is important to remember that portability is not automatic.

19 Nonresident sale of real estate. But this could be changing in the future. Upon the wifes death she can use not only her own 5340000 estate tax exemption but also her husbands remaining 4340000 exemption.

As if income taxes and property taxes werent enough the IRS gets to tax your estate if it is large enough. June 2021 4 In addition to the standard deduction SC has other deductions and exemptions the largest of which are. Inheritance tax from another state Even though South Carolina does not levy an inheritance or estate tax if you inherit an estate from someone living in a state that does impart these taxes you will be responsible for paying them.

The South Carolina State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 South Carolina State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Federal estate tax The federal estate tax is applied if an inherited estate is more than 1158 million. Overall South Carolina tax structure.

Eligible dependents are dependents claimed on your federal Income Tax return. Most property tax exemptions are found in South Carolina Code Section 12-37-220. It only impacts less than 1 of all the states in America.

You can claim up to 10000 in retirement income deductions. We streamlined the property tax exemption application process to. The surviving spouse must be 50 years of age or older.

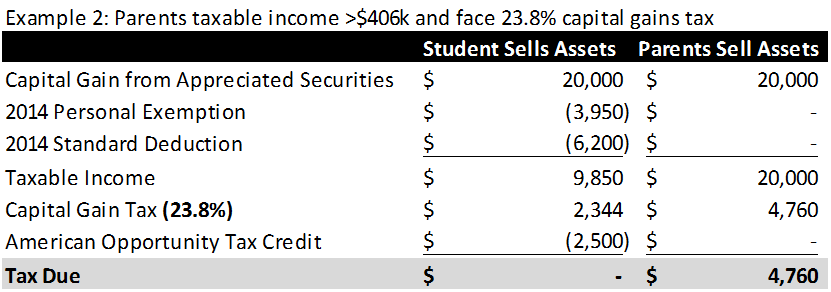

A Individuals estates and trusts are allowed a deduction from South Carolina taxable income equal to forty-four percent of net capital gain recognized in this State during a taxable year except for the portion of the capital gain that was recognized from the sale of gold silver platinum bullion or any combination of this bullion for which the deduction equals one. Real Estate taxation is a year in arrears meaning to be exempt for the current year you must be the owner of record and your effective date of disability must be on or before 1231 of the previous year. What are the recent changes to South.

According to the South Carolina Department of Revenue the Homestead Exemption relieves you from taxation on the first 50000 in fair market value of your owned legal residence if you are over the age of 65 or you are totally and permanently disabled or you are legally blind. In effect husband and wife are treated as one economic unit. The estate tax has been around for decades but it is evolved over time and the exemption has changed.

The fiduciary of a nonresident estate or trust must file a South Carolina Fiduciary Income Tax return if the estate or trust had income or gain that came from South Carolina sources. The South Carolina Department of Revenue is responsible. South Carolina has a capital gains tax on profits from real estate sales.

In theory the tax is rather simple to calculate. No taxes on Social Security means that your retirement income goes even further in South Carolina. But youll still need the assistance of a CPA or another tax professional.

I has been a resident of this State for at least one year and has reached the age of sixty-five years on or before December thirty-first. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. Net capital gain deduction.

W 00 4 Total subtractions add line f through line w. The good news is that the vast majority of the states will not be subject to the tax. The start of a new year frequently includes new or updated statutes and South Carolina is no exception.

Currently the exemption is 117 million for calendar year 2021. Does SC tax pensions and Social Security. W South Carolina Dependent Exemption see instructions.

Real or tangible personal property located within South Carolina. The South Carolina capital gains rate is 7 of the gain on the money collected at closing. However South Carolina also has a 44 exclusion from the capital gains flowing from the 1040 federal return effectively reducing the state tax to 392.

The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. 1 The first fifty one hundred thousand dollars of the fair market value of the dwelling place of a person is exempt from county municipal school and special assessment real estate property taxes when the person. 19 00 20 Other SC withholding attach 1099.

To qualify for the Homestead Exemption you must meet all of the following criteria. See the worksheet below. Detailed South Carolina state income tax rates and brackets are available on this page.

The estate tax is often referred to as the death tax. 2021 INDIVIDUAL INCOME TAX RETURN. The County Assessor however automatically will apply rollback taxes to any property in which the purchaser has not filed an application to continue an agricultural use special assessment ratio property tax exemption.

These benefits are usually available for a surviving spouse if the deceased spouse was 65 or older. The applicable South Carolina county will not prorate rollback taxes between purchasers and sellers. The District of Columbia moved in the opposite direction lowering its estate tax exemption from 58 million to 4 million in 2021 but simultaneously dropping its bottom rate from 12 to 112 percent.

Dependent exemption - as of tax year 2020 4260 can be deducted for each eligible dependent Dependents under six - an additional deduction equal to the dependent deduction can be claimed for each dependent under age six. The state of South Carolina has special provisions on property taxes for home owners who are 65 years of age or older and who have resided in the state for at least one year. In addition to no taxes on Social Security those over 65 are also able to deduct up to 10000 in retirement income from pensions IRAs and the like.

The South Carolina income tax has six tax brackets with a maximum marginal income tax of 700 as of 2022.

How To Avoid Estate Taxes With A Trust

Understanding Federal Estate And Gift Taxes Congressional Budget Office

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Income Tax Employee Incentive Is Part Of Taxable Salary And Fully Taxable The Financial Express

2016 2022 Form Sc St 8 Fill Online Printable Fillable Blank Pdffiller

What Is A Tax Exemption The Motley Fool

Recent Changes To Estate Tax Law What S New For 2019

Income Tax Brackets 2022 Which Are The New Tax Figures And Changes You Need To Know Marca

Solar Tax Exemptions Sales Tax And Property Tax 2022

What Is The Tax Expenditure Budget Tax Policy Center

How To Calculate Capital Gains On Sale Of Gifted Property Examples

Estate Tax Exemption 2021 Amount Goes Up Union Bank

Who Is Exempt From Paying Income Taxes Are Some People Really Exempt From Paying Taxes Howstuffworks

South Carolina Estate Tax Everything You Need To Know Smartasset

Important California Property Tax Exemptions For Seniors Homehero In 2021 Social Security Benefits Property Tax Tax Exemption

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

College Tax Planning Strategies

What Is A Homestead Tax Exemption Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die